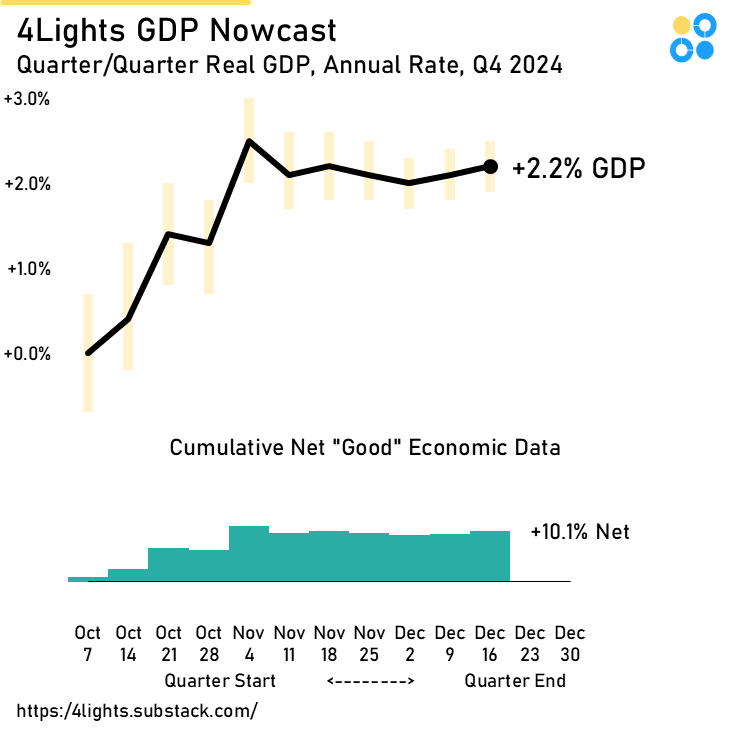

Last quarter, the model predicted nearly +4.0% growth. While we didn’t quite get that high (I didn’t think we would), we did end up with very strong +3.1% GDP in Q3. A lot has happened since then, and there are some signs of slowdown (e.g. rising unemployment levels, slowing construction spending, rising interest rates, etc.), but the numbers are generally solid. Of the 154 data-points collected so far this quarter, 92 have been “good” for a net positive score of +10%. The GDP nowcasting model is now showing +2.2% growth for Q4.

There is definitely a weird mix of euphoria and uncertainty in the economic world right now. Markets skyrocketed post election but have now tumbled back to reality. The Economic Policy Uncertainty Index had one of its largest month-over-month increases ever in November. The Citigroup Economic Surprise Index was looking great throughout November, but has now started to deteriorate. Interesting times ahead!

How are other nowcasts/forecasts looking for Q4, 2024?

New York Fed Staff Nowcast: +1.9%

Atlanta Fed GDPNow: +3.1%

Good Judgement Forecast: between +1.5% and +3.0%

Goldman Sachs: +2.4%